Unlock 2026 Savings: Your Bank Term Deposit Compound Interest Guide

In an ever-evolving financial landscape, securing your future savings requires more than just putting money aside; it demands a smart, strategic approach. As we look towards 2026, understanding how your money can grow passively becomes paramount. Bank term deposits, often seen as a cornerstone of low-risk savings, offer a powerful secret weapon: compound interest. This guide will demystify the magic of compounding, help you navigate the 2026 financial outlook, and show you how a "银行定期存款复利计算器 2026" (Bank Fixed Deposit Compound Interest Calculator 2026) can be your best planning tool.

Whether you're saving for a down payment, retirement, or simply building a robust emergency fund, leveraging term deposits effectively can significantly boost your financial goals. It's not just about the initial interest rate; it's about how that interest, over time, starts earning interest itself, creating a snowball effect for your wealth.

The Power of Compound Interest in Term Deposits

The concept of compound interest is often hailed as one of the most powerful forces in finance, and for good reason. It transforms your savings from a linear growth path to an exponential one, particularly when paired with the stability of bank term deposits.

What is Compound Interest?

At its core, compound interest is "interest on interest." Unlike simple interest, which is calculated only on the initial principal amount, compound interest is calculated on the principal amount *and* also on the accumulated interest from previous periods. Imagine this: you deposit money into a term deposit. After the first period, you earn interest. In the next period, you earn interest not only on your original deposit but also on the interest you've already accumulated. This continuous cycle means your money grows faster over time, accelerating your wealth accumulation without you having to lift a finger.

For example, if you invest $1,000 at a 5% simple interest rate for 5 years, you'd earn $50 each year, totaling $250. With a 5% compound interest rate (compounded annually), your earnings would be significantly higher because each year's interest is added to the principal for the next calculation. Over five years, your initial $1,000 would grow to approximately $1,276.28 – an extra $26.28 purely from the power of compounding. Over longer periods and with larger sums, this difference becomes truly substantial.

Why Term Deposits are Ideal for Compounding

Term deposits, also known as fixed deposits, are particularly well-suited for harnessing compound interest due to several key characteristics:

- Fixed Rates: They offer a predetermined interest rate for the entire duration of the term, providing predictability for your compound growth.

- Predictable Returns: With a fixed rate and a set term, you can accurately forecast your returns, making financial planning much clearer.

- Security and Low Risk: Term deposits in reputable banks are generally considered very low-risk investments, often protected by government deposit insurance schemes. This security ensures your principal and accumulated interest are safe, allowing compounding to work its magic without threat of capital loss.

- Reinvestment Options: Many term deposits offer the option to automatically reinvest your interest back into the principal, directly fueling the compounding process for maximum growth.

Choosing the right term – whether it's 6 months, 1 year, 3 years, or 5 years – will impact how frequently your interest compounds and the overall rate you receive. Generally, longer terms might offer slightly higher rates, but it's a balance with your liquidity needs.

Navigating 2026: Factors Influencing Term Deposit Rates

Forecasting interest rates for 2026 involves looking at broader economic trends and central bank strategies. While no one has a crystal ball, understanding these dynamics can help you make informed decisions about your term deposits.

Economic Outlook and Central Bank Policies

Interest rates are heavily influenced by the prevailing economic climate, particularly inflation and the monetary policies of central banks. As we approach 2026, several factors will likely shape the interest rate environment:

- Inflation Trends: If inflation remains elevated, central banks may keep interest rates higher to curb price increases. Conversely, a moderation in inflation could lead to more stable or even slightly lower rates.

- Economic Growth: Strong economic growth generally gives central banks more room to adjust rates, while a slowdown might prompt more accommodative policies.

- Global Economic Stability: Geopolitical events and the health of major global economies can also ripple through local interest rate markets.

Central banks, through their benchmark rates (like the federal funds rate in the US or policy rates in other regions), directly influence what banks offer for savings products like term deposits. Banks typically offer rates that are a margin above or below these benchmark rates, adjusted for their own operational costs and profit margins. By 2026, we could see a period of stabilization following recent rate adjustments, or continued subtle shifts depending on global economic performance.

Choosing the Right Bank and Term

Even in a broad interest rate environment, specific choices can significantly impact your returns:

- Compare Rates: Don't settle for the first offer. Banks compete for deposits, and rates can vary significantly between institutions. Utilize online comparison tools or visit different bank websites to find the best rates for your desired term.

- Consider Deposit Tenure: While longer terms often come with slightly higher rates, they also lock up your money for longer. Balance the rate advantage with your need for liquidity. A "laddering" strategy (explained later) can help mitigate this.

- Look for Special Promotions: Banks frequently offer promotional rates for new customers or specific deposit amounts. Keep an eye out for these opportunities, especially as you approach key financial periods in 2026.

- Tiered Rates: Some banks offer higher rates for larger deposit amounts. If you have a substantial sum, explore these options to maximize your returns.

Remember that even a slight difference in interest rate can translate into a significant difference in your total accumulated interest over several years, thanks to compounding.

How to Calculate Your Compound Returns: The "银行定期存款复利计算器 2026" in Action

Understanding the theory behind compound interest is one thing; putting it into practice with real numbers is another. This is where a "银行定期存款复利计算器 2026" (Bank Fixed Deposit Compound Interest Calculator 2026) becomes an indispensable tool for forward-looking financial planning.

The Core Formula Explained

The fundamental formula for calculating compound interest is:

A = P (1 + r/n)^(nt)

Where:

- A = the future value of the investment/loan, including interest

- P = the principal investment amount (the initial deposit)

- r = the annual interest rate (as a decimal, e.g., 5% is 0.05)

- n = the number of times that interest is compounded per year (e.g., annually n=1, semi-annually n=2, quarterly n=4, monthly n=12)

- t = the number of years the money is invested or borrowed for

For example, if you deposit $10,000 at an annual interest rate of 3% compounded monthly for 3 years:

- P = $10,000

- r = 0.03

- n = 12

- t = 3

A = 10,000 * (1 + 0.03/12)^(12*3) = 10,000 * (1.0025)^36 ≈ $10,940.51

This formula allows you to precisely predict the growth of your term deposit, taking into account the compounding frequency, which can significantly impact your final returns. The more frequently interest is compounded, the faster your money grows.

Practical Application and Online Tools

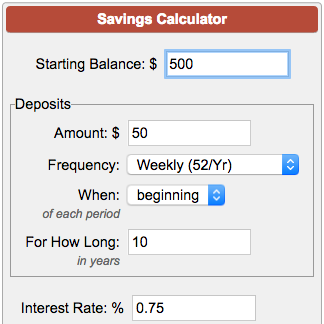

While the formula is powerful, manually calculating for various scenarios can be tedious. This is where online calculators, essentially a "银行定期存款复利计算器 2026," come into play. These tools simplify the process:

- Input Your Principal: Enter the amount you plan to deposit.

- Enter the Annual Interest Rate: Use the rate offered by the bank.

- Specify Compounding Frequency: Select how often interest is calculated and added (e.g., monthly, quarterly, annually).

- Define the Investment Term: Enter the number of years or months for your term deposit.

With these inputs, the calculator instantly shows you your projected future value and the total interest earned. This makes it incredibly easy to compare different bank offers, different compounding frequencies, and varying investment terms to see which option yields the best results for your 2026 planning. For a more in-depth look at calculating these returns, check out our guide on Mastering 2026 Bank Term Deposits: Calculate Your Compound Returns.

Maximizing Your 2026 Term Deposit Strategy

Beyond simply opening a term deposit, there are several strategic approaches you can employ to amplify the effects of compound interest and optimize your savings for 2026 and beyond.

Reinvestment vs. Payout

When your term deposit matures, you typically have two main choices: withdraw the interest or reinvest it. For maximum compounding, always choose to reinvest the interest, along with your principal, if your goal is long-term growth. By adding the earned interest back into the principal, you're immediately increasing the base upon which future interest will be calculated, supercharging the compounding effect. If you opt for a payout, you lose the opportunity for that interest to earn more interest for you.

Laddering Strategy

A popular and effective strategy for managing term deposits is "laddering." This involves dividing your total deposit amount into several smaller deposits with staggered maturity dates. For example, instead of putting $30,000 into a 3-year term deposit, you could put:

- $10,000 into a 1-year term deposit

- $10,000 into a 2-year term deposit

- $10,000 into a 3-year term deposit

As each shorter-term deposit matures, you can then reinvest it into a new, longer-term deposit (e.g., another 3-year term). This strategy offers several benefits:

- Liquidity: A portion of your money becomes accessible more frequently, reducing the risk of needing to break a longer-term deposit early and incur penalties.

- Mitigating Interest Rate Risk: You're not locking all your money into a single rate for a long period. If interest rates rise, you'll have maturing deposits that you can reinvest at the new, higher rates. If rates fall, some of your money will still be locked in at higher rates.

Regular Contributions

While term deposits are often lump-sum investments, making regular, even small, additional contributions to your savings pot can dramatically accelerate your compound growth. Each new contribution adds to your principal, giving compounding more fuel. Consider setting up an automatic transfer from your checking account to your savings account, which you can then periodically consolidate into a new or existing term deposit when you reach a sufficient amount. Even small, consistent efforts yield impressive results over time.

Stay Informed

The financial world is dynamic. Keep an eye on economic news, central bank announcements, and prevailing interest rate trends. Being informed allows you to react strategically, whether it's by locking in a good rate before a potential decline or holding out for higher rates if forecasts suggest an increase. Utilize financial news sources and consult with a financial advisor to fine-tune your strategy. To stay ahead of the curve and understand potential rate shifts, read our analysis on Future-Proof Your Money: 2026 Bank Term Deposit Interest Forecast.

Conclusion

As you plan your financial journey towards 2026 and beyond, bank term deposits, supercharged by the principle of compound interest, stand out as a reliable and effective savings vehicle. By understanding how compound interest works, staying informed about economic factors influencing rates, and employing smart strategies like laddering and reinvestment, you can significantly enhance your wealth accumulation. Don't underestimate the long-term impact of even small interest rate advantages or the power of consistent savings. Tools like a "银行定期存款复利计算器 2026" are invaluable for visualizing your potential returns and making informed decisions. Start exploring your options today, calculate your potential, and unlock a future of stronger, more secure savings.